By Sofia Sanchez Salcedo

The #struggle

Chances are you work a minimum wage job along with 73,000 other Missourians, most of which are in the service industry. The money that college students make never seems to be enough, but there are some straightforward ways to make your money last longer. Keep in mind, as a fellow college student and not a professional CPA, these are techniques I have found help me out.

Rules to save

- Don’t play the lottery. It is, as Ambrose Bierce is quoted as saying, a tax for people who are bad at math. Just like other things in counters at gas stations (I’m looking at you, rotating immortal hot dog), just say no.

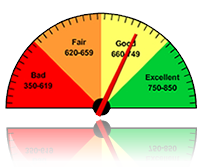

- Don’t phunk with my score. Get your finances in order before you enter into a committed relationship where you can mess up someone else’s credit. True love waits (until you get your finances together).

- Pay for bills (school, rent, food, car loan, etc.) before you spend money on things that aren’t going to be repossessed (movie tickets, questionable hot dogs, etc.). Keep all receipts so you know what your money is going into.

- Don’t loan money to friends that you aren’t okay with never getting back. Friends and money don’t mix. Consider it a gift, and be pleasantly surprised if they pay it back. In the same vein, don’t borrow money from a close friend unless you have a payment plan in place.

- Make an emergency fund: for this you might want to also save a portion of your check, and put it into a savings account. If you save 10 dollars a week, you’ll have 520 dollars, which can help you if your car breaks down or if you have a medical emergency.

- Spend money on what you need first, and what you want second. This goes along with paying your bills before you spend it on other things, but it also involves making sure what you are buying will benefit you in the long run. For instance, will buying a new CD be more beneficial than gas money for your goals? If you are a music major who lives in the dorms, maybe. For most of us, we should save up that gas money.

- Don’t use credit cards unless you really can afford to. Debit cards spend money you have in the bank today, while credit cards is basically like making a bet that at the end of the month you will be able to pay it off. Chances are, if you don’t pay attention to what you swipe your card on, you will not be able to pay it off until your tax returns or Christmas, when you can sell all of those socks your aunt with all the cats gives you (thanks, Aunt Gertrude!).

- Fill out your Free Application for Federal Student Aid, or FAFSA, once a year to figure out how much you can get help for in your college career. The Educational Opportunity Center (EOC) has a main office and an office in most of the surrounding campuses that can help you with this. Furthermore, if you can, avoid loans, but if you absolutely must, get subsidized loans. Visit the Financial Aid office for more information about this.

- Make sure you read the fine print, and don’t sign anything you are unsure about until you consult it with your parents, or someone you trust who preferably has a degree in relation to your question.

- Lastly, make sure you understand that saving money shouldn’t be a sacrifice. You aren’t going to enjoy your life if you are miserly, but if worse comes to worse, you’ll appreciate making a little cushion for yourself.

Leave a Reply